Connected Enterprise Market by Platform (Device, Connectivity Management & Application Enablement), Solution, Service (Professional and Managed Services), Vertical, and Region - Global Forecast to 2021

[148 Pages Report] The connected enterprise market is estimated to grow from USD 102.60 billion in 2016 to USD 400.87 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 31.3% during the forecast period. The base year considered for the study is 2015 and the forecast period is from 2016 to 2021. The connected enterprise industry is likely to be impacted by some disruptive technologies such as digital healthcare technology, streaming, and data analytics.

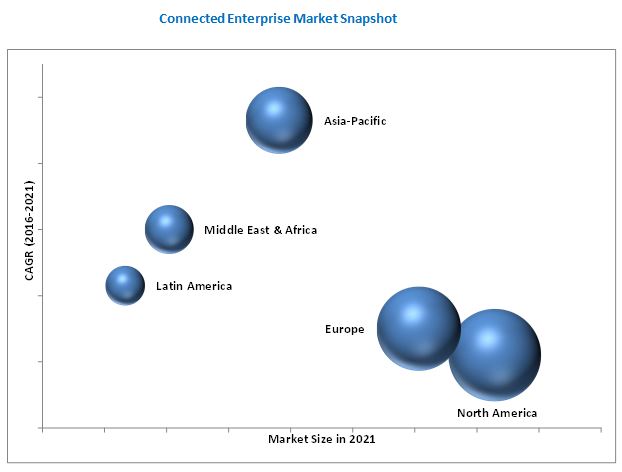

The integration of connected enterprise helps IT infrastructure to monitor, analyze, and control the main network connectivity. Platforms such as device management and connectivity management have high global acceptance in the IT industry; however, the emerging application enablement platform is expected to witness high growth rate. The global connected enterprise market is expected to grow significantly during the forecast period. North America is expected to hold the largest share of the market, followed by Europe.

Market Dynamics

Drivers

- Increasing need of automation and cloud computing across industries

- Realized potential of voluminous data for better processes and operations

- Steep surge in technological advancements such as big data, cloud, and mobile devices in enterprise

- Reduced cost of maintenance on account of smart connected devices

Restraints

- High cost of deployment

- Lack of uniform IoT standards and technological skills

Opportunities

- Rising adoption of IoT in small and medium businesses

- Rising demand of system integrators

Challenges

- Lack of data management and interoperability

- Security over the network of connected devices spread across enterprises

Increasing need of automation and cloud computing across industries

In order to sustain in the era of competition, industries across all domains are embracing IoT practices. The connected equipment and devices not only benefit in terms of streamlining enterprise processes, but also help businesses understand the actual potential for better outcome. Owing to the increasing population, the demand for better manufacturing resources and infrastructure is becoming an important issue, which needs to be resolved to ensure optimum availability of industrial products for direct and commercial consumers. Automation helps an enterprise run at its best capacity, and thereby save time, energy, and funds, thereby increasing overall productivity. The cloud computing is proving to be a catalyst for growing IoT practices among enterprises on account of its flexibility. Clouds have solved the problem of data management to a large extent and the devices connected in an enterprise are directly allowed to store their data over the clouds and make analytics and decision making possible.

Objectives of the Study

- To define, describe, and forecast each segment of the connected enterprise market on the basis of platforms, solutions, services, and verticals

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry specific challenges)

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To forecast the market size of the segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their recent competitive developments and positioning such as mergers & acquisitions and new product developments in the market.

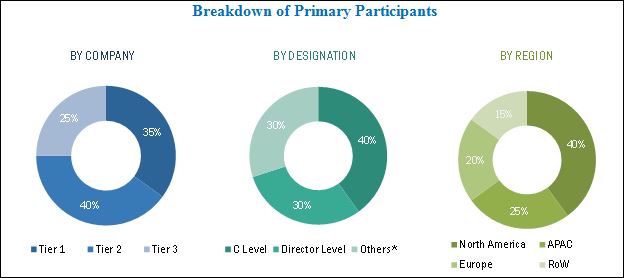

The research methodology used to estimate and forecast the connected enterprise market begins with capturing data on key vendor revenues through secondary research such as National Telecommunication and Information Administration (NTIA) report. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global connected enterprise market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The connected enterprise market ecosystem comprises vendors such as Rockwell Automation Inc. (U.S.), Cisco Systems Inc. (U.S.), IBM Corporation (U.S.), Microsoft Corporation (U.S.), Bosch (Germany), Honeywell International (U.S.), GE (U.S.), Accelerite (U.S.), Verizon Communications Inc. (U.S.), and PTC (U.S.) that maintain and update the entire software system and sell them to end users to cater to their unique business requirements.

Major Market Developments

- In April 2016, IBM partnered with Kimberly-Clark, a U.S. based company. The Kimberly-Clark's professional division will adopt IBM Cloud and IBM Watson IoT platform to develop a new intelligent facilities management app.

- In July 2016, Google collaborated with Rentokil Initial Plc and PA Consulting Group for expanding Rentokil's global product availability through Google's cloud platform and PA's Agile technology, which is highly scalable and efficient.

- In August 2016, AWS expanded its business of configuration management services by increasing the regional availability of AWS OpsWork in Frankfurt, Ireland, N. California, Oregon, Sγo Paolo, Seoul, Singapore, Sydney, and Tokyo.

Key Target Audience

- Semiconductor companies

- Embedded systems companies

- Application developers and aggregators

- Managed service providers and middleware companies

- Wireless infrastructure providers and service providers

- Data management and predictive analysis companies

- Sensor, location, and detection solution providers

- Internet identity management, privacy, and security companies

- Machine-to-Machine (M2M), IoT, and telecommunications companies

Scope of the Report

The research report categorizes the connected enterprise market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Platform

- Device Management

- Connectivity Management

- Application Enablement

By Solution

- Real-Time Collaboration

- Enterprise Infrastructure Management

- Streaming Analytics

- Security Solution

- Data Management

- Remote Monitoring System

- Network Management

- Mobile Workforce Management

- Customer Experience Management

- Asset Performance Management

By Service

- Professional Services

- Consulting Services

- Integration and Deployment Services

- Support and Maintenance

- Managed Services

By Verticals

- BFSI

- Healthcare and Life Sciences

- Retail and Ecommerce

- Telecommunication and IT

- Manufacturing

- Government

- Energy and Utilities

- Media and Enterprises

- Others

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- Which solutions hold the maximum opportunity of growth in connected enterprise market?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed information and product comparison

Geographic Analysis

- Further breakdown of the North America connected enterprise market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

Company Information

- Detailed analysis and profiling of additional market players

The connected enterprise solutions and services offer a pro-active and real-time monitoring of business activities, providing comprehensive control over various tasks in the enterprise ecosystem. The security solution is growing rapidly owing to the increasing adoption of connected enterprise systems and growing security concerns.

The connected enterprise market is broadly classified into solutions, services, platforms, verticals, and regions. The solutions segment is further divided into real-time collaboration, enterprise infrastructure management, streaming analytics, security solution, data management, remote monitoring solution, network management, mobile workforce management, customer experience management, and asset performance management. Compared to solutions, the services segment is expected to grow at a higher CAGR during the forecast period. The services in the connected enterprise market are aimed at enabling smart and coordinated decision-making processes and mitigating the risks and vulnerabilities of Internet of Things (IoT) in enterprises using efficient tools and techniques. Moreover, these services enhance data management techniques and help to meet the end-to-end needs of all the verticals.

The security solution is expected to grow at the highest CAGR during the forecast period, as it is specifically focused on data security, which is the prime need of the enterprise. Moreover, the data management solution offers flexibility and scalability to enterprises, as their most important asset is data. These solutions help the enterprises gain operational efficiency and bandwidth as per their requirement.

With the increasing usage of numerous devices across enterprises, various advanced threats have also evolved and the need to maintain the safety and confidentiality of enterprise data has become crucial. Due to the large number of devices connected in a connected system, tampering with even a single device in the network can turn out to be a potential threat for the enterprise. Connected devices need a dedicated security solution as this need cannot be met by PC security solutions for IoT embedded devices.

The adoption of connected enterprises solutions and services is growing at a fast pace in the developing regions. North America is expected to account for the largest share in the connected enterprise market, followed by Europe, in 2016. Rising need for automation and cloud computing across industries is one of the important market drivers for connected enterprises. Another important driver is the realized potential of voluminous data for better processes and operations in enterprises. However, the lack of standardized skills and privacy & security issues act as major restraining factors for the market.

Increasing need of automation and cloud computing across industries drives the investment in the connected enterprise market

BANKING, FINANCIAL SERVICES, AND INSURANCE

The Internet of Things (IoT) has a powerful impact on banking and financial services as it will lead to discovery of concealed facts. Integrating IoT with BFSI would help in customer engagement, building customer loyalty and leading to acquisition and retention of customers. Nowadays, it is very difficult for banks to differentiate themselves according to the product and prices they offer to their customers. Banks can monitor the spending pattern of customers to come up with suitable offers for customers. Through sensors, banks can send offers to the customers as soon as they enter a branch office. Connected enterprise would help in business improvements by tailoring the products and services according to the customer. Through sensor data, BFSI organizations will be able to improve customer experience and back-office performance. Financial institutions can redefine their customer engagement and should take the competitive advantage offered by IoT.

TELECOMMUNICATIONS AND IT

Unlike other industries, connected enterprise has an altogether different role in the telecommunications and IT sector. With growing complexities in the infrastructure of telecom services, the need to keep track of the elements in the system has increased exponentially. IoT helps in updating IT architectures, operations, and process policies to renovate efficiency. Telecommunication service providers can cut down on their operational cost by applying middleware for software defined networking and network function virtualization. IoT in telecommunication and IT is helpful in terms of enhanced data security and privacy, interoperability, asset management, and real-time analytics, among others.

RETAIL AND E-COMMERCE

E-commerce and retail is growing every year and has no signs of slowing down in the future. The IoT technology would help in reshaping and revolutionizing the retail industry by creating new opportunities for customer services and supply chain and improving customer experience. IoT has helped retailers with tools and insights to transform their business by automating the business, refining the business processes, and reducing the operational cost. IoT helps in inventory management by deploying sensors and RFID tags on the products to track them in real time. It helps in fleet management by allowing a certain set of rules to be followed, i.e., the delivery route, recommended speed, and alerts for any extended stoppages. IoT helps in real-time promotions, which are sent on the basis of the customers shopping history, personal preferences, and location.

HEALTHCARE AND LIFE SCIENCES

IoT connected to various systems and products is changing the businesses in the healthcare industry. Both patients and doctors are benefited from IoT devices, which can be accessed by mobile applications that allow users to monitor the health data. The reason for this trend is that integrating IoT features into medical devices greatly improves the quality and effectiveness of services, bringing especially high value for the elderly, patients with chronic conditions, and those requiring constant supervision. IoT can be used to supplement patient treatment through remote monitoring and communication, and to keep track of patients as they move through a healthcare facility. This could cut down the necessity for routine reviews and checkups. Therefore, IoT helps organizations to take up the critical data in a real time and achieve a better decision capability.

MANUFACTURING

IoT has improved visibility in manufacturing to the point where each unit of production can be seen at each step in the production process. It brings the opportunity for the manufacturing companies to make a change in operational innovation and operational excellence. Manufacturers are continuously adding software and sensors to the products providing IoT function, which in turn becomes the critical components in smart manufacturing. IoT lowers cost, reduces resource consumption, optimizes operations, improves productivity, enhances customer service and manages the supply chain operations, leading to revenue growth and cost savings.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What strategies are the vendors adopting to increase their hold over the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The connected enterprise market is growing rapidly and is being widely accepted across the regions. The solutions and services that connected enterprise offers are proving to be very efficient for getting optimum production with minimal utilization of the resources. There are several established players in this market such as Rockwell Automation, Inc. (Wisconsin, U.S.), Cisco Systems, Inc. (California, U.S.), PTC, Inc. (Massachusetts, U.S.), Microsoft Corporation (Washington, U.S.), IBM Corporation (California, U.S.), Robert Bosch GmbH (Stuttgart, Germany), Honeywell International, Inc. (New Jersey, U.S.), General Electric (New York, U.S.), Accelerite (California, U.S.), and Verizon Communications, Inc. (New Jersey, U.S.).

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Report

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Connected Enterprise Market

4.2 Market Share Across Various Regions

4.3 Connected Enterprise: By Vertical and Region

4.4 Lifecycle Analysis, By Region (2016)

4.5 Market Investment Scenario

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Platform

5.2.3 By Service

5.2.4 By Vertical

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need for Automation and Cloud Computing Across Industries

5.3.1.2 Realized Potential of Voluminous Data for Better Processes and Operations

5.3.1.3 Reduced Cost of Maintenance on Account of Smart Connected Devices

5.3.1.4 Steep Surge in Technological Advancements Such as Big Data, Cloud, and Mobile Devices

5.3.2 Restraints

5.3.2.1 High Cost of Deployment

5.3.2.2 Lack of Uniform IoT Standards and Technology Skills

5.3.3 Opportunities

5.3.3.1 Rising Adoption of IoT in Small and Medium Businesses

5.3.3.2 Rising Demand for System Integrators

5.3.4 Challenges

5.3.4.1 Lack of Data Management and Interoperability

5.3.4.2 Security Concerns Regarding the Network of Connected Devices Spread Across Enterprises

6 Industry Trends (Page No. - 44)

6.1 Value Chain Analysis

6.2 Ecosystem

6.3 Strategic Benchmarking

7 Connected Enterprise Market Analysis, By Type (Page No. - 47)

7.1 Introduction

8 Market Analysis, By Platform (Page No. - 49)

8.1 Introduction

8.2 Device Management

8.3 Connectivity Management

8.4 Application Enablement Platform

9 Connected Enterprise Market Analysis, By Solution (Page No. - 54)

9.1 Introduction

9.2 Real-Time Collaboration

9.3 Enterprise Infrastructure Management

9.4 Streaming Analytics

9.5 Security Solution

9.6 Data Management

9.7 Remote Monitoring System

9.8 Network Management

9.9 Mobile Workforce Management

9.10 Customer Experience Management

9.11 Asset Performance Management

10 Connected Enterprise Market Analysis, By Service (Page No. - 66)

10.1 Introduction

10.2 Professional Services

10.2.1 Consulting Services

10.2.2 Integration and Deployment Services

10.2.3 Support and Maintenance Services

10.3 Managed Services

11 Connected Enterprise Market Analysis, By Vertical (Page No. - 74)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Telecommunications and IT

11.4 Retail and Ecommerce

11.5 Healthcare and Life Sciences

11.6 Manufacturing

11.7 Government

11.8 Energy and Utilities

11.9 Media and Entertainment

11.10 Others

12 Geographic Analysis (Page No. - 84)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 105)

13.1 Overview

13.2 Competitive Situations and Trends

13.3 Partnerships, Agreements, and Collaborations

13.4 New Product Launches

13.5 Acquisitions

14 Company Profile (Page No. - 111)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 Geographic Revenue Mix

14.3 Rockwell Automation, Inc.

14.4 Cisco Systems, Inc.

14.5 MnM View

14.6 Parametric Technology Corporation, Inc. (Thingworx)

14.7 Microsoft Corporation

14.8 International Business Machines Corporation

14.9 Robert Bosch GmbH

14.10 Honeywell International, Inc.

14.11 General Electric

14.12 Accelerite

14.13 Verizon Communications, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 138)

15.1 Excerpts From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (70 Tables)

Table 1 Connected Enterprise Market Size and Growth 20152021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Type, 20152021 (USD Billion)

Table 3 Market Size, By Platform, 20152021 (USD Billion)

Table 4 Platform: Market Size, By Region, 20152021 (USD Million)

Table 5 Device Management: Market Size, By Region, 20152021 (USD Million)

Table 6 Connectivity Management: Market Size, By Region, 20152021 (USD Million)

Table 7 Application Enablement Platform: Market Size, By Region, 20152021 (USD Million)

Table 8 Connected Enterprise Market Size, By Solution, 20152021 (USD Billion)

Table 9 Real-Time Collaboration: Market Size, By Region, 20152021 (USD Million)

Table 10 Enterprise Infrastructure Management: Market Size, By Region, 20152021 (USD Million)

Table 11 Streaming Analytics: Market Size, By Region, 20152021 (USD Million)

Table 12 Security Solution: Market Size, By Region, 20152021 (USD Million)

Table 13 Data Management: Market Size, By Region, 20152021 (USD Million)

Table 14 Remote Monitoring System: Market Size, By Region, 20152021 (USD Million)

Table 15 Network Management: Connected Enterprise Market Size, By Region, 20152021 (USD Million)

Table 16 Mobile Workforce Management: Market Size, By Region, 20152021 (USD Million)

Table 17 Customer Experience Management: Market Size, By Region, 20152021 (USD Million)

Table 18 Asset Performance Management: Market Size, By Region, 20152021 (USD Million)

Table 19 Market Size, By Service, 20152021 (USD Billion)

Table 20 Services: Market Size, By Region, 20152021 (USD Million)

Table 21 Professional Services: Market Size, By Type, 20152021 (USD Million)

Table 22 Professional Services: Market Size, By Region, 20152021 (USD Million)

Table 23 Consulting Services Market Size, By Region, 20152021 (USD Million)

Table 24 Integration and Deployment Services Market Size, By Region, 20152021 (USD Million)

Table 25 Support and Maintenance Services Market Size, By Region, 20152021 (USD Million)

Table 26 Managed Services: Market Size, By Region, 20152021 (USD Million)

Table 27 Connected Enterprise Market Size, By Vertical, 20152021 (USD Million)

Table 28 Banking, Financial Services, and Insurance: Market Size, By Region, 20152021 (USD Million)

Table 29 Telecommunications and IT: Market Size, By Region, 20152021 (USD Million)

Table 30 Retail and Ecommerce: Market Size, By Region, 20152021 (USD Million)

Table 31 Healthcare and Life Sciences: Market Size, By Region, 20152021 (USD Million)

Table 32 Manufacturing: Market Size, By Region, 20152021 (USD Million)

Table 33 Government: Market Size, By Region, 20152021 (USD Million)

Table 34 Energy and Utilities: Market Size, By Region, 20152021 (USD Million)

Table 35 Media and Entertainment: Market Size, By Region, 20152021 (USD Million)

Table 36 Others: Market Size, By Region, 20152021 (USD Million)

Table 37 Connected Enterprise Market Size, By Region, 20152021 (USD Million)

Table 38 North America: Market Size, By Type, 20152021 (USD Million)

Table 39 North America: Market Size, By Platform, 20152021 (USD Million)

Table 40 North America: Market Size, By Solution, 20152021 (USD Million)

Table 41 North America: Market Size, By Service, 20152021 (USD Million)

Table 42 North America: Market Size, By Professional Service, 20152021 (USD Million)

Table 43 North America: Market Size, By Vertical, 20152021 (USD Million)

Table 44 Europe: Connected Enterprise Market Size, By Type, 20152021 (USD Million)

Table 45 Europe: Market Size, By Platform, 20152021 (USD Million)

Table 46 Europe: Market Size, By Solution, 20152021 (USD Million)

Table 47 Europe: Market Size, By Service, 20152021 (USD Million)

Table 48 Europe: Market Size, By Professional Service, 20152021 (USD Million)

Table 49 Europe: Market Size, By Vertical, 20152021 (USD Million)

Table 50 Asia-Pacific: Connected Enterprise Market Size, By Type, 20152021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Platform, 20152021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Solution, 20152021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Service, 20152021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Professional Service, 20152021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Vertical, 20152021 (USD Million)

Table 56 Middle East and Africa: Connected Enterprise Market Size, By Type, 20152021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Platform, 20152021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Solution, 20152021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 20152021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Professional Service, 20152021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Vertical, 20152021 (USD Million)

Table 62 Latin America: Connected Enterprise Market Size, By Type, 20152021 (USD Million)

Table 63 Latin America: Market Size, By Platform, 20152021 (USD Million)

Table 64 Latin America: Market Size, By Solution, 20152021 (USD Million)

Table 65 Latin America: Market Size, By Service, 20152021 (USD Million)

Table 66 Latin America: Market Size, By Professional Service, 20152021 (USD Million)

Table 67 Latin America: Market Size, By Vertical, 20152021 (USD Million)

Table 68 Partnerships, Agreements, and Collaborations, 20152016

Table 69 New Product Launches, 20142016

Table 70 Acquisitions, 20142016

List of Figures (50 Figures)

Figure 1 Connected Enterprise Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Connected Enterprise Market is Poised to Witness Growth in the Global Market From 2016 to 2021

Figure 7 Market Snapshot on the Basis of Platforms: 2016

Figure 8 Market Snapshot on the Basis of Types (2016 vs 2021)

Figure 9 Professional Services Constitutes Larger Market Share: 2016

Figure 10 Market Snapshot on the Basis of Verticals (2016 vs 2021)

Figure 11 Lucrative Market Prospects in the Market Due to Higher Adoption of Connected and Smart Devices

Figure 12 North America is Expected to Command the Major Share of the Market in 2016

Figure 13 Manufacturing Accounted for the Largest Market Share in the Year 2016

Figure 14 Asia-Pacific to Enter the Exponential Growth Phase During 20162021

Figure 15 Market Investment Scenario

Figure 16 Market Segmentation By Solution

Figure 17 Market Segmentation By Platform

Figure 18 Connected Enterprise Segmentation: By Service

Figure 19 Connected Enterprise Market Segmentation: By Vertical

Figure 20 Market Drivers, Restraints, Opportunities, and Challenges

Figure 21 Market Value Chain

Figure 22 Market Ecosystem

Figure 23 Services Segment is Expected to Grow at A High CAGR in Market During the Forecast Period

Figure 24 Device Management Platform is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Security Solution to Grow at the Highest CAGR During the Forecast Period

Figure 26 Professional Services is Expected to Have Largest Market Size in Connected Enterprise Market During the Forecast Period

Figure 27 Integration and Deployment Services Segment is Expected to Have the Largest Market Size in Professional Services Market During the Forecast Period

Figure 28 Healthcare and Life Sciences to Grow at the Highest CAGR During the Forecast Period

Figure 29 North America Contributes the Largest Market Share to the Global Market (20162021)

Figure 30 Regional Snapshot: Asia-Pacific is the New Hotspot in the Market During the Forecast Period

Figure 31 North America Market Snapshot: Increasing Connected and Intelligent Device Adoption Rate is A Major Factor Contributing to the Growth of the Market in This Region

Figure 32 Asia-Pacific Market Snapshot: Smart City and Wearable Technologies are Contributing to the Growth of the Connected Enterprise Market in This Region

Figure 33 Companies Adopted the Strategy of Partnerships, Agreements, and Collaborations as the Key Growth Strategy From 2014 to 2016

Figure 34 Market Evaluation Framework

Figure 35 Battle for Market Share: Companies Adopted the Strategy of Partnerships, Agreements, and Collaborations to Strengthen Their Market Position

Figure 36 Geographic Revenue Mix of the Top Five Market Players

Figure 37 Rockwell Automation, Inc.: Company Snapshot

Figure 38 Rockwell Automation, Inc.: SWOT Analysis

Figure 39 Cisco Systems, Inc.: Company Snapshot

Figure 40 Cisco Systems, Inc.: SWOT Analysis

Figure 41 Parametric Technology Corporation, Inc.: Company Snapshot

Figure 42 Parametric Technology Corporation, Inc.: SWOT Analysis

Figure 43 Microsoft Corporation: Company Snapshot

Figure 44 Microsoft Corporation: SWOT Analysis

Figure 45 International Business Machines Corporation: Company Snapshot

Figure 46 International Business Machines Corporation: SWOT Analysis

Figure 47 Robert Bosch GmbH: Company Snapshot

Figure 48 Honeywell International, Inc.: Company Snapshot

Figure 49 General Electric: Company Snapshot

Figure 50 Verizon Communications, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Connected Enterprise Market